When I was a teenager in the 1980s, I wanted a pair of tan Dr. Scholl’s sandals so badly I could taste it. Each time my mother took us to the Eckerd drug store, I made sure to stroll down that aisle to check them out.

“Those are the dumbest shoes I’ve ever seen in my life,” Mom said, and she flat out refused to buy them for me.

Today, I’d have to agree. With hard, wooden soles and an adjustable strap that featured a gold buckle and grommets, these were not what Tim Gunn would consider classic fashion pieces.

But I wanted those shoes dearly.

They cost $14.95—pricy for a kid with no job and a $1 a week allowance. My mom suggested I save up my own money for them. But savings from my February birthday was long gone, and by the time I saved enough allowance, summer would be over. These shoes were definitely not fall footwear.

So, my mother came up with another idea: to ask my father for a loan. And that’s exactly what I did.

Both of my parents were educators—my mother an elementary school librarian and my father a division chair and sometimes-teacher at the local community college. It’s fair to say that the man never missed an opportunity to give me a lesson about money management. And these lessons also often included a little bit of math.

The Dr. Scholl’s loan was no different.

Instead of giving me the money outright and keeping my allowance for the next 15 weeks, I got a simple-interest loan that was to be paid within a certain time period. I don’t remember how long the term or what the interest rate was. But I did continue to receive my weekly allowance and paid a portion of that amount each week for the loan. Dad even helped me calculate how much more I’d be paying for the sandals with the interest.

As a kid who only wanted her hands on a pair of fad sandals, I thought this was overly complex. But my desire for those shoes was great, and this was the only way I’d get them. So I agreed. I signed the contract he wrote out by hand and paid off that loan, plus the interest, bit by bit.

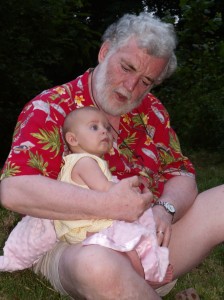

Today, as the parent of an 11-year-old daughter, I’m amazed by my father’s foresight. It really is a brilliant little trick, and one that has served me very, very well.

Six years later, my dad took me down to the Bank of Speedwell to get a loan for my first car—a 1984 Toyota Camry that I bought from my aunt for $2,000. This time he explained compound interest, just before he cosigned for the loan.

And that lesson didn’t stop with me. Two years later, my sister gave me the most amazing gift when I graduated from college—an upright piano that she purchased from a neighbor. She paid Bud and Ginia Cabell $20 a month for I don’t know how long. (And now my daughter plays Mozart waltzes on that very instrument.)

The thing that I know about my dad is that he wasn’t afraid to delve into the tough stuff with us—including managing our money. That often required a few calculations, and I often resisted his lessons.

When it came to these little real-world lessons, I’m sure I was a royal pain in the you-know-where, but in the end, those experiences were much more meaningful than anything I learned in school—and they were less expensive than anything I could learn on my own.

My daughter hasn’t asked for her version of ugly, wooden sandals, but I’m waiting for that moment. And when she does, I’ll be ready with a contract and a little lesson in simple interest and regular payments.

Did you get any surprise lessons like this one when you were little? Or do you have plans to do something similar with your own kids — or grandkids, nieces, nephews, neighborhood kids? Share your stories in the comments sections below.